The Verdict on Saving for Law School

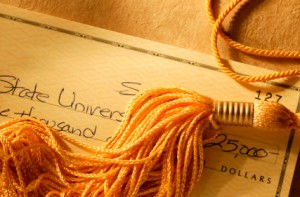

While law school certainly is regarded as a prestigious preparation for an impressive career, it comes with a hefty price tag attached. To put it in perspective, the average cost of attending law school can be between $45,000 to approximately $60,000 per year, or even more for the top colleges. Most law programs usually last for three years. Apart from the core tuition expenses, potential applicants also need to consider the costs of books and educational materials, transportation, meals, and housing. Consider it from another angle. Assuming that a law student graduates and immediately gets a full time job, if they put their entire salary towards paying school debts, it would take three to four years. When applying to law school, it is crucial to consider all the aspects and first decide whether law school really is for you. Those who are indeed committed to entering the law profession can finance their education in several different ways, including scholarships and other types of financial aid.

While law school certainly is regarded as a prestigious preparation for an impressive career, it comes with a hefty price tag attached. To put it in perspective, the average cost of attending law school can be between $45,000 to approximately $60,000 per year, or even more for the top colleges. Most law programs usually last for three years. Apart from the core tuition expenses, potential applicants also need to consider the costs of books and educational materials, transportation, meals, and housing. Consider it from another angle. Assuming that a law student graduates and immediately gets a full time job, if they put their entire salary towards paying school debts, it would take three to four years. When applying to law school, it is crucial to consider all the aspects and first decide whether law school really is for you. Those who are indeed committed to entering the law profession can finance their education in several different ways, including scholarships and other types of financial aid.

- An Overview of Law School Financing Options

- Understanding Law School Costs

- Is Law School Right for You?

After accepting an offer from a law school, it is helpful first to meet with a counselor at their financial aid department. These counselors will discuss all the possible types of financial aid in further detail and help students to find the best options for their economic situation. The best way to finance a law education is to try to do it while incurring the least amount of debt as possible. Debt comes with interest, which essentially increases the education costs. The first resource for financial aid is to look within the institution itself. Law schools typically offer a host of scholarships and grants for students who meet certain criteria. This can include high grades, volunteer participation, race or ethnicity, financial status, and more. Research these in detail and apply for all that you might be eligible for. Another source of financial aid is local or even national companies and organizations. For example, check for grants offered by law associations, cultural groups, or organizations related to law education for young people. Students should also discuss their financing options with their parents. Some companies offer scholarships and other types of education financial aid for their employees’ children. If this is available, it can help the student to offset a portion of their tuition fees. Some parents may also choose to help their children by paying a portion of the school fees. Many students also opt to take financial aid from the government in the form of a loan. However, keep in mind that this results in a high level of interest, which only adds to the already high level of debt.

Working while going to school is an option that is viable but should be considered carefully. Law school usually involves an average of thirteen hours of classes each week. Factor in time for studying, research, and working on assignments, and it adds up to approximately 50 to 60 hours each week that are dedicated to education. Those who can still find some time to work can do so if it does not affect their grades negatively. Typical student jobs involve bartending, restaurant work, lifeguarding, and babysitting. Try to find other jobs based on campus so that it is easier to go to work after classes. This might include working at the gym or library or becoming a teaching assistant. An alternative is to work full time during the summer months, so that the school year can be dedicated to only study. If none of these options are appealing, a work-study program might fit the bill. In this scenario, students spend part of the academic year in classes, and the rest working in a career-related position at a company. They are paid and may also receive school credit for the work that they do, since it is akin to on-the-job learning.

- Ideas for Financing Law School

- A Look at How Students Pay for Law School

- Resources for Law School Scholarships and Financial Aid

- Different Sources for Law School Scholarships

- Tips for Coping with Law School Costs

Although law students often struggle under the strain of the education costs, the burden can be less with enough advance planning and saving. Students who are committed to working in a law career will find that the extra time and effort certainly do pay off in the long run. Make sure to thoroughly research all of the available options before deciding on a financial aid plan.

Instead, they took the actual number of reported years it took a student to graduate from each institution to compile the costs of college. In addition, PayScale also attempted to take into account those who attended school yet never graduated.

Instead, they took the actual number of reported years it took a student to graduate from each institution to compile the costs of college. In addition, PayScale also attempted to take into account those who attended school yet never graduated.

But most were merciless in their criticism of the 27-year-old. Robbie Cooper at

But most were merciless in their criticism of the 27-year-old. Robbie Cooper at  The availability to readily access information on the web about a candidate has created a whole new phenomena called personal branding. It is a concept every high school and college student needs to become aware of and breaks down simply: it is extremely important that when your name is Googled, positive information comes up.

The availability to readily access information on the web about a candidate has created a whole new phenomena called personal branding. It is a concept every high school and college student needs to become aware of and breaks down simply: it is extremely important that when your name is Googled, positive information comes up.  For years, the generally accepted figure associated with earning a college diploma has been $1 million. Those calculated additional earnings a college graduate earns in his lifetime above and beyond of a classmate with just a high school diploma continue to be used as the rationale for earning that coveted diploma.

For years, the generally accepted figure associated with earning a college diploma has been $1 million. Those calculated additional earnings a college graduate earns in his lifetime above and beyond of a classmate with just a high school diploma continue to be used as the rationale for earning that coveted diploma. As a monetary investment that number still seems reasonable. We certainly can advocate spending $60,000 knowing full well we can one day expect to pocket $280,000 as a result. Add in the ability to better control one’s career choice and the investment seems to be a no-brainer.

As a monetary investment that number still seems reasonable. We certainly can advocate spending $60,000 knowing full well we can one day expect to pocket $280,000 as a result. Add in the ability to better control one’s career choice and the investment seems to be a no-brainer. At the university level, you will also meet many interesting people and have access to adults who are willing to help you learn new things. Once in the world of work, there will be far fewer people willing to help you become successful.

At the university level, you will also meet many interesting people and have access to adults who are willing to help you learn new things. Once in the world of work, there will be far fewer people willing to help you become successful. While it is far more enjoyable to ease through four years of college study with a focus entirely on academics and your social life, the simplest way to minimizing debt is to work when you can.

While it is far more enjoyable to ease through four years of college study with a focus entirely on academics and your social life, the simplest way to minimizing debt is to work when you can. If choosing a dream college means borrowing then you should rethink your choice. State universities offer quality educational options often at half the price.

If choosing a dream college means borrowing then you should rethink your choice. State universities offer quality educational options often at half the price. Select one card based on its cash back or reduced-expenditure percentage that makes sense for you. Some cards reduce gas purchases by a nickel a gallon, others offer cash back on all online purchases, still others offer travel benefit options.

Select one card based on its cash back or reduced-expenditure percentage that makes sense for you. Some cards reduce gas purchases by a nickel a gallon, others offer cash back on all online purchases, still others offer travel benefit options.