Five Steps to Graduating College, Debt-Free!

Most people will insist that college cannot be done without some form of financial assistance. That is most likely true for the vast majority of prospective college students.

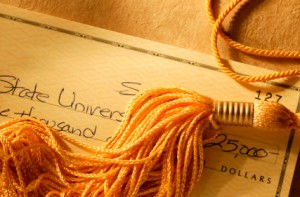

However, the idea that one must borrow significant sums of money to earn that coveted diploma is not entirely true. In fact, it is possible to graduate with little, to no debt if you follow these five basic steps.

Earn Money While Attending College

While it is far more enjoyable to ease through four years of college study with a focus entirely on academics and your social life, the simplest way to minimizing debt is to work when you can.

While it is far more enjoyable to ease through four years of college study with a focus entirely on academics and your social life, the simplest way to minimizing debt is to work when you can.

During the summer months look to work two jobs if you can. Not only can you bank significant amounts of your earnings if you set your mind to it, keeping busy during the summer months helps reduce your spending tendencies. The result is a win-win.

In addition, plan on working, at least part-time during the school year. Working as little as 6-8 hours a week can produce ample amounts of ongoing spending money. Push it to 12-18 hours and you can actually earn enough money to pay next semester’s fees and book costs.

Lastly, research schools that offer co-op work options. Many schools are affiliated with specific industries whereby students can combine work and study options. With such a program, students earn money while working in their desired field or the company receiving work services helps pay a portion of the student’s college costs.

Select Your College Based on Costs

After countless hours of preparation, it may seem that your choice of college should be based on prestige. That simply is not the case in the long run.

What is true is a diploma from a prestigious school can help you with that first job. But thereafter, your value to any employer will be based on your performance.

If choosing a dream college means borrowing then you should rethink your choice. State universities offer quality educational options often at half the price.

If choosing a dream college means borrowing then you should rethink your choice. State universities offer quality educational options often at half the price.

Beginning your career in a financially stable position will allow you the time to prove yourself. If you accrue significant debt while in school, that debt will impact your career options for years to come, forcing you to choose employment based solely on pay.

Apply for Scholarships and Grants

Research every scholarship and grant option available to you, whether it be from your home town, your high school, your chosen college, etc. Then apply for every one that matches your situation.

This is free money, as good as any you can earn, and can go a long way towards reducing college costs. Also, many scholarships and grants are renewable: once you have obtained one, as long as you meet the academic expectations you may well receive the funds for all four years.

Be sure to research school-related options that pertain to your area of study. Some may not be available until your third or fourth year of school.

One, Paid-off Credit Card

As you enter adulthood, you will be besieged by credit card offers. Each will likely offer a free gift in return for signing up.

Select one card based on its cash back or reduced-expenditure percentage that makes sense for you. Some cards reduce gas purchases by a nickel a gallon, others offer cash back on all online purchases, still others offer travel benefit options.

Select one card based on its cash back or reduced-expenditure percentage that makes sense for you. Some cards reduce gas purchases by a nickel a gallon, others offer cash back on all online purchases, still others offer travel benefit options.

Select the one card that works best for you and say no to all other cards. Limit your use to those purchases where it directly benefits you; otherwise pay cash to ensure you realize just how much you are spending with each transaction.

Most importantly, pay the monthly balance every month. Do not accrue interest or payment fees. Those costs can kill you, putting you quickly into a position where the card expenses are more than you can handle.

If you cannot discipline yourself to pay off the monthly balance, then cut the card in half and dispose of it. A significant amount of debt accrued by college students is directly attributed to the ease at which credit cards facilitate unwarranted discretionary spending.

Consider Living at Home

One of the biggest college expenses is the cost of room and board. Clearly, if you are attending school a significant distance from home, you will need to consider living on campus.

But living at home can save you significant sums of money. Many students are taking advantage of their community college network, living at home for the first year or two of study while earning their basic course credits.

For those who live near their state college, the same opportunity is available.

Living at home will limit the social options, no doubt, but college is first and foremost about earning a degree. Minimizing room and board expenses is an excellent way to reduce the costs of college and helping you graduate debt-free.

Graduate with a Secure Future

Earning a college diploma can be the catalyst to a wealth of career options but the debt you accumulate while earning that diploma can greatly impact those options. The best way to ensure your future is to minimize the debt you accrue while securing that coveted diploma.

With a little extra effort and a few sacrifices, it is possible to earn a diploma and remain debt-free in the process.